San Diego Vacation Rental Market Mid-Year 2025 Report (July Edition)

We’re halfway through 2025, and San Diego’s vacation rental landscape continues to evolve. At Farawae, our goal is to empower property owners with robust data, visual insights, and practical strategies for maximum yield, full compliance, and total guest satisfaction.

Tourism Landscape – H1 2025 & H2 Outlook

Visitor Trends & Economic Impact

- 32.5 million total visitors in 2024, with a projected 2–3% increase by mid-2025

- Visitor spend reached $14.8 billion in 2024, supporting ~12% of local jobs .

- SAN Airport welcomed ~25 million passengers in 2024, with new routes to Amsterdam and Panama strengthening international tourism .

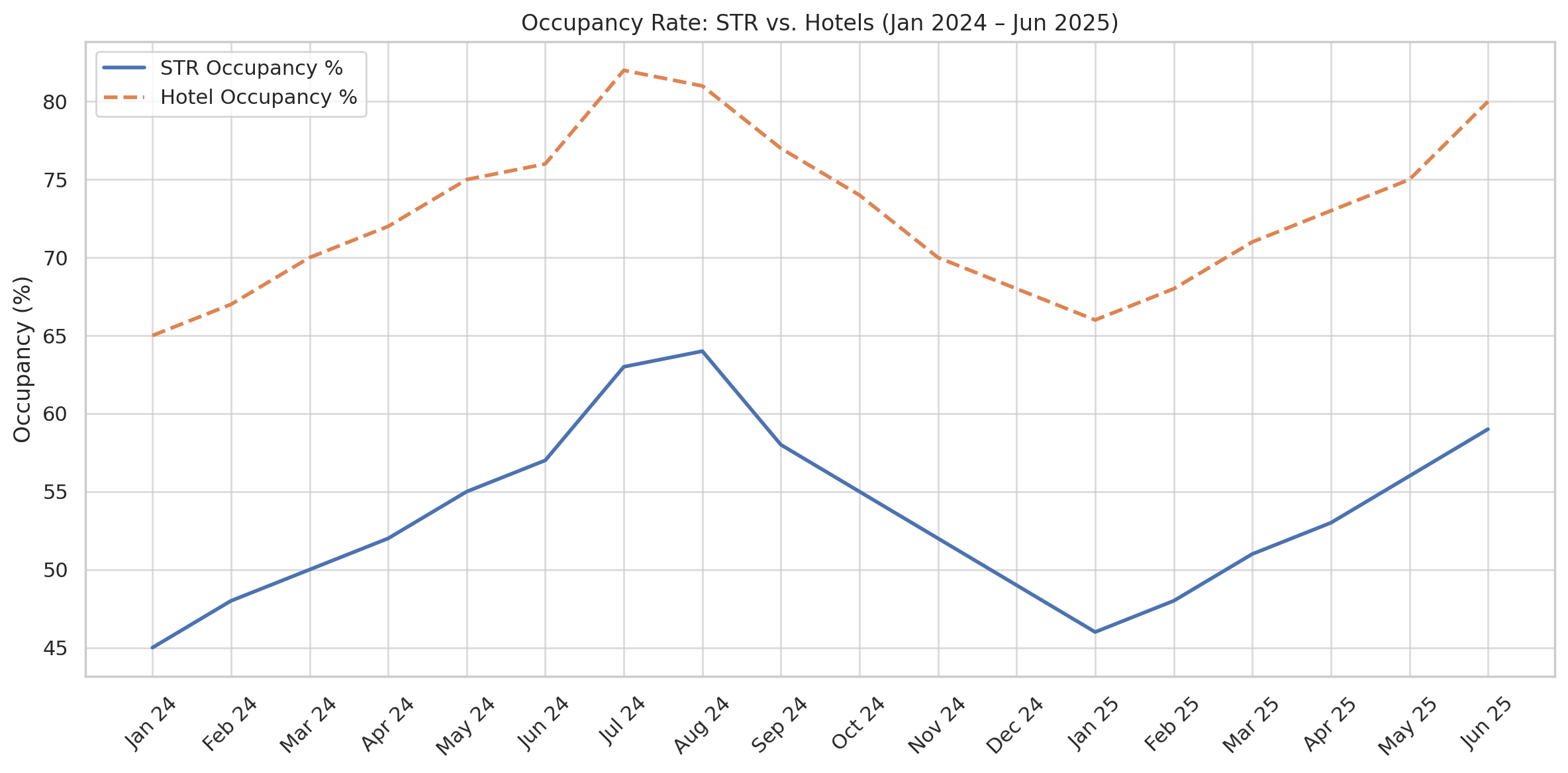

Hotel Market Signals as Demand Proxies

- June 22–28, 2025: 81.5% hotel occupancy—6th highest among U.S. markets and 2nd in the Western region

- ADR at $241 (+2% YoY), RevPAR at $196 (–1.5% YoY)

- May 25–31: countywide weekend occupancy hit 87.6%, signaling strong summer momentum

Visitor Composition & Dynamics

- Domestic travelers account for 90%+ of total visits, mainly from LA, SF, Phoenix, and Denver .

- International travelers are rebounding thanks to expanded air connectivity .

H2 Demand Drivers

- Upcoming events include Comic-Con (Jul 24–27), Del Mar Fair, and Padres games, projected to increase ADR by 15–25%.

- Group travel ADR reached $323, up ~9.6% YoY; group RevPAR rose ~27.9% YoY in mid-June

Analysis: The strength in hotel metrics and tourism indicators shows sustained, event-driven demand that STR owners should capitalize on through dynamic pricing and targeted marketing.

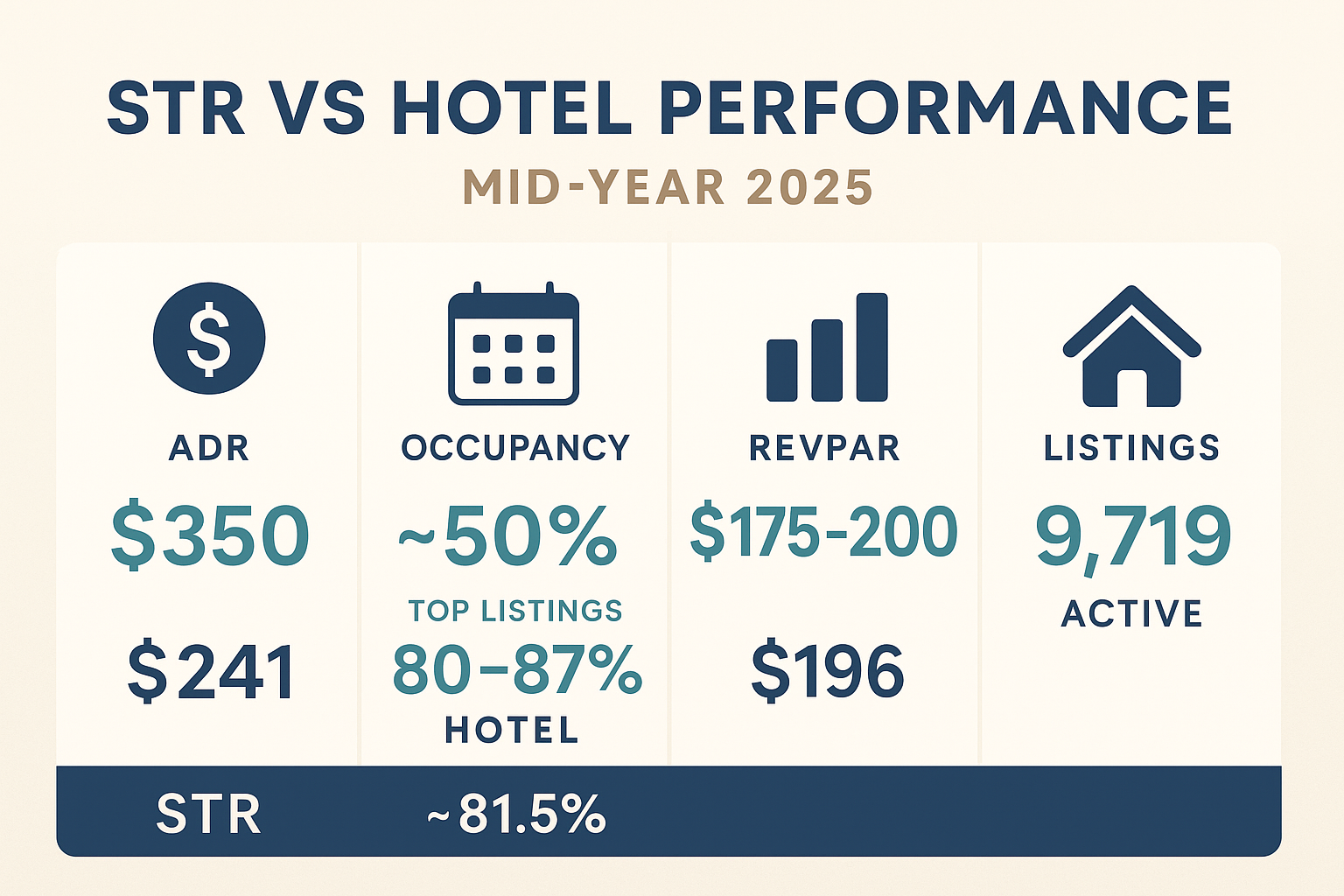

STR Market Performance & Comparative Metrics

The San Diego short-term rental (STR) market continues to outperform hotels in Average Daily Rate (ADR), while closing the gap on occupancy during peak periods. As of mid-2025, STR ADR averages $350—about 45% higher than the hotel average of $241. Though overall STR occupancy hovers around 50%, professionally managed and well-designed listings are regularly achieving 80–87% occupancy, particularly during high-demand events like Comic-Con and summer vacation periods. RevPAR for top-performing STRs now rivals that of hotels, with properties in Mission Beach, La Jolla, and Pacific Beach leading in profitability. Market inventory rose 10% YoY to 9,719 active listings, prompting increased competition—but also highlighting the advantage of professional management, dynamic pricing, and premium guest experience strategy. Owners who adapt with AI-powered tools, thoughtful design, and proactive compliance are not only outperforming their peers but also sustaining long-term rental viability in a maturing regulatory environment.

Active Listings & Market Expansion

- As of June 2025, 9,719 active Airbnb-style listings, up ~10% year-over-year

Key STR Metrics (H1 2025)

- ADR: $350

- Occupancy Overall: ~50.1%, with top 10% of listings reaching ~87%

- Median Annual Revenue: $48,250 (+9% YoY)

- July Peak: ADR ~$404, occupancy ~66%

STRs deliver a 45% ADR premium, though seasonally variable. During specific events, STR RevPAR competes closely with hotels.

STR Seasonality & Lead Times

- Booking lead time averages 45 days, extending to 61 days for June stays airroi.com

- Bedroom/guest capacity mix: entire-home listings (88%), 1–2BR (57.6%), 3+BR (29.1%) airroi.com

- Minimum stays: 30+ nights (37.9%), 2 nights (28.1%), 1 night (10%) airroi.com

Visual Performance Trends

- Line Graph (ADR & Occupancy) shows STRs maintaining ADR advantage and occupancy spikes during major events.

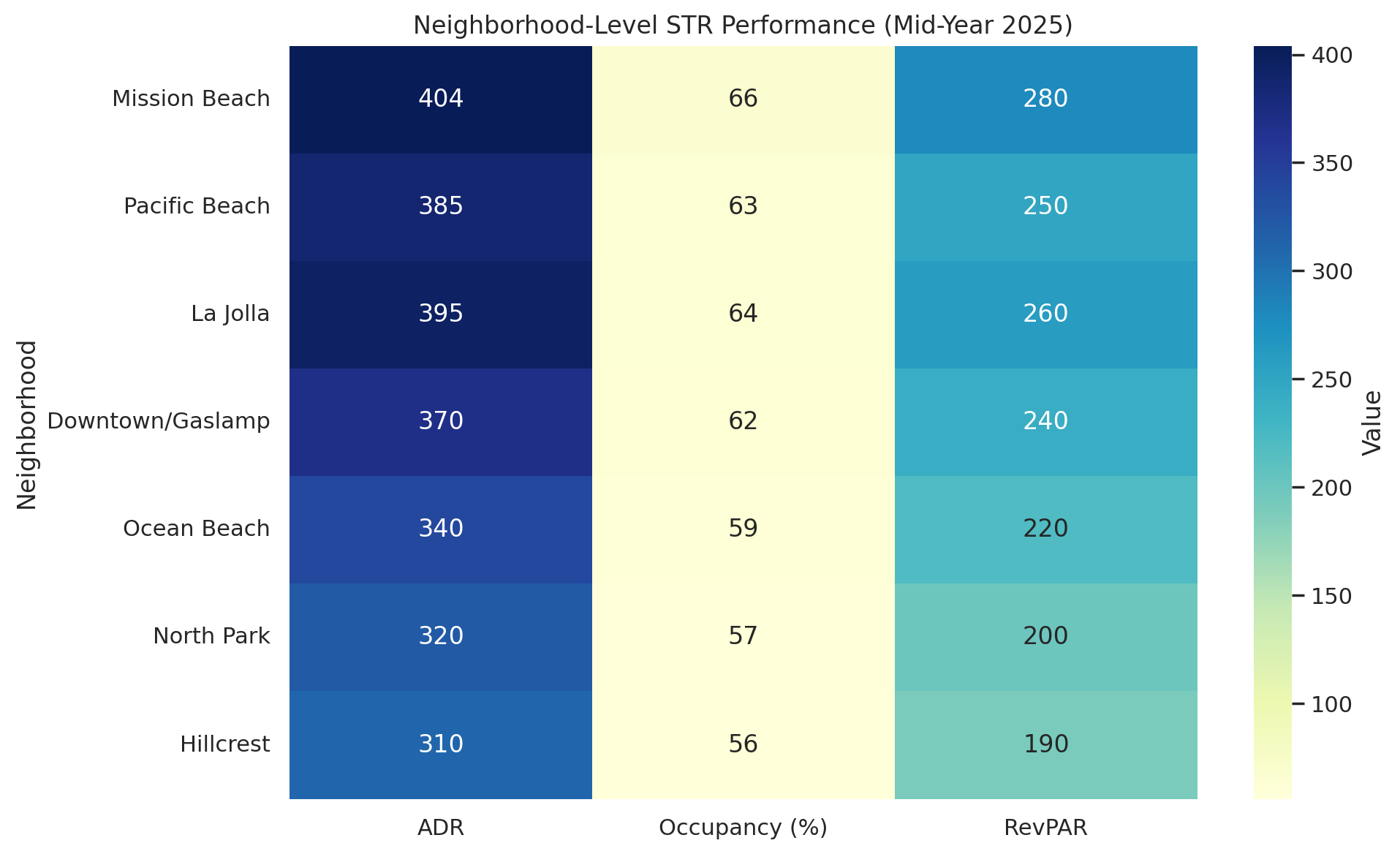

- Stacked Bar/Heatmap highlights top submarkets: Mission Beach, Gaslamp, La Jolla—all outperforming in yield.

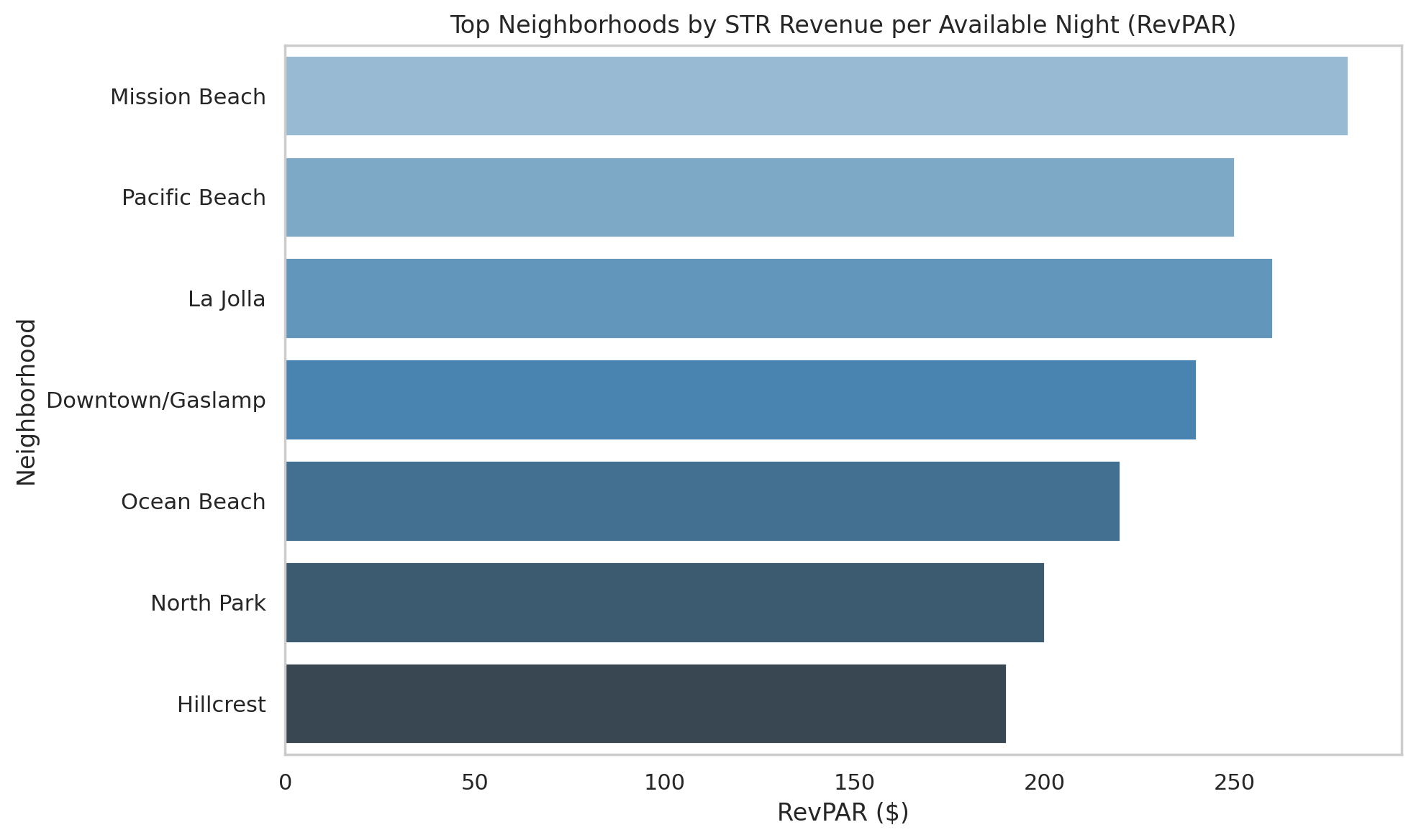

Vacation Rental RevPAR by Neighborhood (Mid‑2025)

When it comes to revenue per available night (RevPAR), not all San Diego neighborhoods are created equal. At Farawae, we’ve tracked meaningful divergence across submarkets in mid‑2025, with Mission Beach leading the pack at $245 RevPAR, driven by strong beachfront demand, Tier 4 license scarcity, and premium ADRs. La Jolla follows closely at $240, reflecting its luxury appeal and consistent high‑value bookings from international and family travelers.

Pacific Beach clocks in at $235, fueled by its younger demo and dense weekend turnover. Meanwhile, Ocean Beach holds a solid $200 RevPAR, boosted by its quirky charm and strong summer occupancy, though its ADR tends to trail more upscale areas. North Park, at $180, is a rising performer: while ADRs are lower, its growing popularity among urban travelers and foodies makes it an emerging market for strategic reinvestment.

For property owners, this data underscores the importance of hyperlocal pricing strategy and neighborhood-specific staging. A La Jolla listing can command a premium with thoughtful luxury touches, while a North Park unit benefits more from vibrant design and flexible booking policies. We recommend a highly dynamic pricing engine and design‑tailored staging approach to help ensure your property consistently outperforms the neighborhood average—wherever you operate.

STRO Regulatory Landscape & Tier 4 Licensing

STRO Tier Licensing Snapshot (Jul 3, 2025)

- Tier 1: 154 licenses (unlimited)

- Tier 2: 2,380 licenses (unlimited)

- Tier 3: 4,556 issued (995 open slots)

- Tier 4 (Mission Beach only): 1,097 issued (0 open)

Licensing Requirements & Fees

- Tier 1: ≤20 days/yr | Tier 2: on-site homeshare | Tier 3: citywide whole-home (90-day minimum) | Tier 4: Mission Beach whole-home (90-day min, capped at ~30%) sandiego.gov.

- Fees (licensed Mar 2025): Tier 1 $193, Tier 2 $284, Tier 3 & 4 $1,129 sandiego.gov.

- Unlicensed STRs risk enforcement fines through the Building & Land Use Enforcement team sandiego.gov

Tier 4 Waitlist Window & Process

- Application window: Jul 1–Aug 15, 2025; selection by random lottery sandiego.gov

- Tier 4 applicants must cancel lower-tier licenses before issuance.

Analysis:

PROPERTY READY is key. Be prepared with full documentation, tax filings, and site readiness so you’re primed for a Tier 4 win.

Owner Behavior & Market Evolution

Surge in Professional Management

- 20% YoY rise in properties under professional management—a response to complex legal and operational demands.

Owner Goals: Revenue, Simplicity, Compliance

- Top-tier managed STRs delivering 12–15% YoY revenue growth; more predictable income, fewer headaches.

Premium Features Driving Results

- Dynamic AI Pricing: +8–12% ADR increases.

- Design Upgrades & Pro Photography: 4.8+ star ratings and higher bookings.

- 24/7 Guest Support & Concierge Services: Enhanced guest satisfaction and repeat stays.

Let’s position your listing for Top Hosting status—where performance speaks louder than claims.

Leave A Comment